Happy Holidays to Everyone and I hope you are enjoying a nice, relaxing holiday season. It seems like every day gets a little slower as we look forward to the pause Christmas, Hanukkah and New Years brings. And with the news out of the Fed and BLS this week on inflation and rates, it seems like the market is looking for a pause too. That’s because we didn’t quite get the “two for two” result the market was hoping for that probably would have started a nice Santa Claus rally to close out the year. Instead, we got some mixed results and now the market is trying to figure it out.

The first thing we saw right out of the gate this week was good news on the inflation front with CPI coming down to 7.1% y/y. Month over month numbers also came in flat to negative so that was good news. That markets welcomed that with a nice rally to start the week. But then on Wednesday, the Fed raised rates again, this time by 50 bps, to continue their historic rate hiking cycle. They also released their December projections which indicates they expect further slowdown in the economy by lowering their projection on real GDP growth to 0.5% (from 1.2% in September) and increasing their projection on unemployment to 4.6% (from 4.4% in September). Chairman Powell didn’t help very much either by staying hawkish and commenting that they will “stay the course until the job is done” implying more rate hikes are on the table. So that basically threw cold water on the party now to close out the week here.

What’s going on right now is a disconnect between the market and the Fed. Much like I wrote about last week where there is an imbalance in supply and demand. But in this case, the market is butting heads with the Fed right now because the market thinks the Fed is going to drive us into recession and the Fed simply doesn’t. One easy way to see this is to look at the what the market thinks the Fed Funds Rate will be next year versus what the Fed says it will be. You can see what the Fed thinks in their December projection which shows 5.1%. Then you can see what the market thinks in the Fed Funds Futures where it is projecting 4.24% That clearly shows a disconnect where the Fed thinks it can raise rates higher than what the market thinks it has to. And that is the reason why we are seeing down markets right now. Because the market is afraid the Fed is going to raise rates too much. It’s a pretty simple distinction but the ramifications are risky which is why we have been seeing so much volatility this year and probably into next year until things settle down and this gap between the Fed and the market narrows. It should eventually as typically divergences like this do. But we shall see and it will take some time.

In the meantime, as investors, we should always try to look beyond this and always keep in mind that the markets are always forward looking. Not backward looking. Which is what the Fed does. They rely on backward looking data to make their decisions. But that’s not what the market does. It’s also important to keep in mind where you start. So if you think about it in that context and also consider maybe right now is not the best time to be looking ahead because we are in a state of flux right now and not necessarily in a “steady state” environment where anything makes sense. Then all we can do is try to determine when the market would consider us to be in steady state which points to a possible scenario into next year where inflation could possibly come down and supply/demand imbalances work themselves out. Which would then lead to earnings bottoming out. Which we all know earnings are most likely going to be down in the early part of 2023 simply because of the effect of inflation on margins. We are seeing that in the inflation data released this week by the fact that inflation still remains high. But we are also seeing that hit closer to home in the retail sales released just yesterday that showed consumers are pulling back on spending because of inflationary pressures. We are also seeing it in retailer inventories which have steadily been rising. So, if you can look beyond the current state of flux we are in right now and consider a possible scenario where inflationary pressures calm, supply/demand comes more into balance, and earnings begin trending up, then that will be a good sign for the markets which should then provide us some relief.

So, the question is how do you position your portfolio for that? Well, in the near term, continue to stay focused on defense and quality. In equities, that would be in sectors like healthcare, staples and utilities. Even dividend stocks. In fixed income, that means investment grade bonds in core fixed income holdings, low duration risk and especially treasuries right now with short term yields in the 4% range – risk free by the way. Then, depending on your outlook for when that gap between the Fed and the market closes, that is when you would shift into early-stage cyclicals, small cap equities, and value. You can even shift into themed based sectors and tactical areas of the market that may do better on a turnaround that have been really beaten down. Like semiconductors. Especially with the new chip legislation. In fixed income, that’s when you would add to areas like high yield. And you could even think about emerging markets and EM debt especially with the dollar at all time highs and potentially at its peak if indeed inflation and US yields begin coming down.

And don’t forget on the global scale, there are two big wild cards out there right now: Zero Covid in China and the war in Ukraine. If there is any indication that either or both of those challenges have a chance to resolve themselves in the new year, that should ease a lot of uncertainty in the markets. Especially if China begins reopening that should increase demand from that side of the world and should improve all facets of economic activity over there. This is probably something we should expect and prepare for in 2023.

All of these ideas and themes are what we here at GVA Asset Management are thinking about and will discuss in more detail at our next Investment Committee meeting scheduled for next Thursday, December 22. We will talk about all of that and more and formulate a plan for trading in the models. Some of the trade ideas we are going to talk about right off the bat are selling off some of the energy exposure in the models in favor of technology as tech is so cheap right now (maybe buy into the chips space), selling off our exposure to high yield in favor of core bond, and harvesting losses to close out the tax year (and gains this year to offset losses).

In closing, we all know that one of the keys to investing is to diversify away risk. But another very important one is being confident enough to look ahead and ignore the noise going on behind the scenes. Right now, there is plenty of noise. Which is being caused by imbalances in the supply/demand chain as well as this disconnect we are seeing front and center this week with the Fed’s new projections and the market’s expectations. But if you can look ahead and put yourself in the market’s shoes when things eventually settle down then that’s a different narrative than what we are seeing right now.

Thanks for reading and have a great weekend!

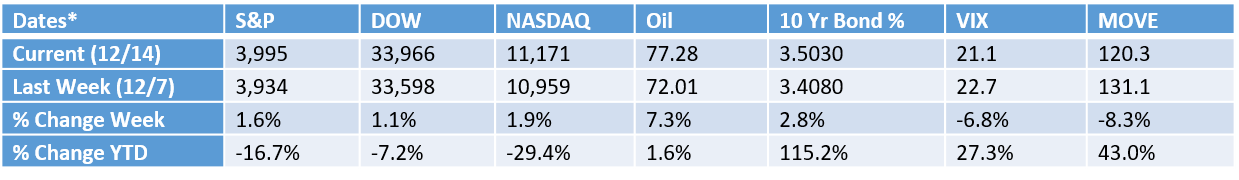

*All data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Compliance Tracking#: 1-05352248