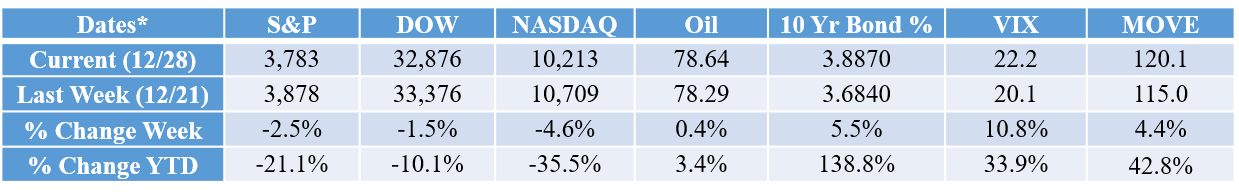

Happy New Year! This week, we’ve had a bit of an up and down week in the markets as it has been trying to eke out a Santa Claus rally. One developing story that may shake things up is the news out of China about another Covid outbreak. This is certainly not what anyone wants to hear but it is looming out there and now the US is requiring airline passengers from China to test negative for Covid before entering the US. As the world turns…

Anyway, this is a short week, and we have the new year upon us so in keeping with that, let’s keep this note short and focused on the work we were doing this week in the models for the 2022 year-end rebalance to a “new year” allocation. In preparation for the trades, the GVA Investment Committee met on Thursday last week and then last Friday we also met with a select group of GVA advisors where the goal in both sessions was to talk about the asset allocation in the models and brainstorm ideas. Between the two groups, four shifts in exposure were discussed:

- Trim energy for healthcare.

- Sell out of high yield for intermediate term treasuries.

- Sell out of commodities for core bond.

- Sell out of hedged equity for dividends in the aggressive models and higher quality bonds in the conservative models.

Each of these shifts reflects the same sentiment we have been advocating all year which is to stay defensive and focus on quality.

Speaking of sentiment, the recent AAII sentiment survey released December 22 shows bearish sentiment at a 9-week high. No surprise there given the way the market has been trading all year. And what could potentially be on the horizon for us in 2023. To name a few, a continued hawkish Fed, lingering inflation, supply chain challenges and the war. And now a potential Covid outbreak in China. Another unsettling stat from last week was put volume on single stocks and ETFs hit 2.1 million, the most on record. This type of options trading has driven the put/call ratio to notable record highs this year and is just another sign of what we are faced with as investors at this time. But navigating around this environment has always led us back to the same defensive and quality theme which has been our mantra all year.

Hopefully 2023 will bring more balance and stability to the markets. But in the meantime, let’s ring in the new year and here’s to our health and happiness! Happy 2023!

*All data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Alternative investments may not be suitable for all investors and should be considered as an investment for the risk capital portion of the investor’s portfolio. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Tracking 1-05353569