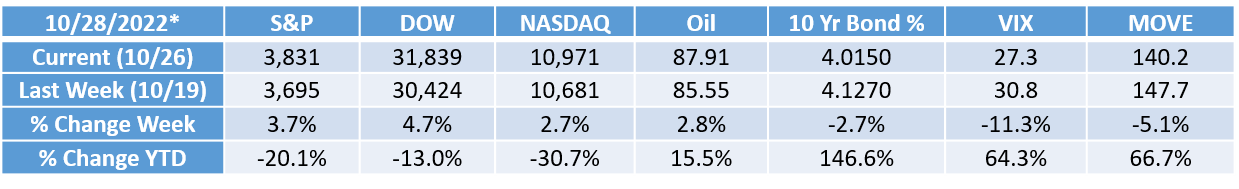

This week, the market showed us a mixed bag as disappointing earnings came out from big tech which led to several choppy sessions during the week. Google, Microsoft, and Meta all reported lackluster results which brought the markets down, along with quite a bit of market cap in the process. Hopefully, Apple and Amazon will turn it around with their reports coming in after the bell on Thursday.

What’s interesting so far with this earnings season is we have seen favorable reports from the banking sector and not so favorable reports from the tech sector. That may still be highlighting the inflationary challenges the tech space is experiencing. Or possibly supply chain issues with chips. But on Thursday, we got some better news with the GDP report that was very well received by the markets. It came in at +2.6% growth for the third quarter. This is quite a shift from when we saw two consecutive quarters of negative growth in July. So that was nice to see. Exports and consumer spending on both goods and services led GDP higher while slowdowns in housing were the drag. Which makes a lot of sense given where we are right now in the economic cycle.

Another interesting thing to look at when thinking about GDP is the Financial Obligations Ratio showing the percentage of after-tax income the consumer spends on fixed payment obligations like a mortgage, rent, or car payments. If you look at the FRED chart, it shows it in the 14.3% range right now which is pretty low compared to past history. That is a great sign because it shows the consumers’ fixed obligations right now are very low. This may also infer that the bulk of consumers across America have locked in lower rate mortgages that give them more discretionary money to spend which is a 70% contributor to GDP. It could also potentially help the consumer with higher borrowing costs on credit cards as the Fed continues to tighten.

Speaking of the Fed, we will get another round of rate hikes next week when the Fed meets November 1-2. Without a doubt, they will raise rates once again by 75 bps. This can also be seen in the FOMC watch probabilities where current odds are 88% for a 75 bps hike.

As we continue down this path of rate hikes and Fed tightening and in the spirit of Halloween on Monday, let’s take a step back here and consider if the market is spooked by all of this right now. Well, one school of thought here could be that markets have already priced in pretty much most of what the Fed could potentially do to get us to a Fed funds rate in the 4.6% range as Powell has already said, especially after all this downside pressure we’ve seen this year. Consider over the last decade, we have all enjoyed a zero-interest rate environment where stocks have been the go-to choice. But now, maybe the market is shifting its mentality away from a zero-rate environment to a more sustained rate environment where interest rates will just simply be higher. So, it may simply be accepting the inevitable. And if it has already priced higher rates in, then valuations may take a leg up as things settle down in 2023. Then if earnings can hold their projected 7.3% growth rate (see top of page 6 here) which is right in the range of the 7.8% average historical earnings growth of the S&P 500 then the market may already be telling us there is no spook to be had here!

To put that thought in further context here with earnings, check out this report from Ed Yardeni of Yardeni research which shows consensus forecasts of future earnings in Figure 2 on page 3. Note the green and blue lines show higher estimates going forward which is a good sign for earnings. And given the stock market historically trades on earnings, that paints a nice picture looking ahead when rates eventually settle in.

Another thing to consider is when you plot the stock market on a logarithmic scale versus a linear scale (which normalizes percent change), then it actually looks like it is trading rationally at this point. To see that, click on this link here and toggle the “log scale” box on/off. The linear scale shows a hyperbolic pattern while the log scale shows a linear pattern. Linear implies rationality.

It has been a busy week with earnings and the GDP report. Next week will be busy too as more earnings come in. But as we frame out the overall stock market here within the backdrop of the economy, it doesn’t appear like the market is “spooked” at the moment but instead coming to terms with reality.

Happy Halloween!

*All data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Tracking# 1-05344306