Earnings Season officially kicked off this week and if this year has been any indication of what to expect then we should fasten our seatbelts. But so far, it has actually been pretty good with the banks all posting fairly nice results. The market welcomed that as we saw a nice rally to start the week. JP Morgan lead off last Friday with a beat on both the top and bottom lines as they took advantage of rising rates to generate more interest income. Which has generally been the theme across the board for all the banks who have reported so far. Such as Wells Fargo and Bank of America. Even Citizens Financial, a stock we own in the models, reported the same thing as their net interest margin went up from 2.72% to 3.24% y/y. So it’s nice to see even the regional banks are getting in on the action. Another thing the CFG CEO said on CNBC this week is they are leading the banking industry in originations on home equity loans right now as people want to keep those low mortgages intact but tap into the post-Covid appreciation in equity in their homes to further strengthen their balance sheets. Speaking of which, this just gives us more reason to keep thinking that the consumer is in a good position right now with added levers to boost cash reserves.

It was nice to see the banks start off the week with a bang. Then, on Tuesday, one of our darlings in the Triumph stock model, Netflix, reported a great quarter with the big news being a new advertising tier for subscribers at $6.99 per month. Which is $1 less than rival Disney + in the streaming space. The stock shot up almost 15% on the news and even better was the +2.4 million subscriber growth as their model appears to be back on track with hit shows like “Stranger Things” and “The Watcher”.

We will see what the next few weeks bring as we hear from other areas of the market but the key thing to remember with all of this is as earnings go so do the markets. It always does. This chart from Macrotrends shows that relationship very well. There really isn’t much more to say on that other than Corporate America typically dictates the direction of the stock market. As it should be. All of this other stuff going on out there – the war, the Fed, the energy crisis, China’s Zero Covid, supply chain, those are all distractors to what actually drives stock prices. Which is simply earnings. It’s the idea that stock prices are driven by the expansion of the economy which drives revenues which drives earnings. So, let’s see how this quarter plays out but of course, the other side to that idea is you can’t focus on the short term, but the LONG TERM as Corporate America navigates the waters.

In other news this week:

- We heard from President Biden that he authorized the release of 15 million barrels of oil from the Strategic Petroleum Reserve through December. This will unfortunately take the reserves down even more after they were already at historic lows, but it should offer some relief at the gas pump.

- China opened session on the Communist Party Congress on Sunday October 16 which is meeting to decide on an unprecedented third 5–year term for President Xi. He opened the session with a speech emphasizing self-reliance, tech supremacy and military power. If he does get re-elected, then it will most likely bring some stability to the region – and the world – because people will have the last decade of his rule to base expectations going forward. This should introduce some ease in both China and global markets even while Zero Covid continues over there.

- Don’t lose sight of the Atlanta Fed’s GDPNow estimate. Because over the last several weeks, it has taken quite a turn to the POSITIVE which indicates they think we will now see +2.9% GDP growth in the third quarter. That’s quite a turn and a strong signal the economy will not fall into recession.

Finally, remember one basic axiom about investing in the stock market. Over the LONG TERM, investors earn the “equity risk premium” (the difference between average stock market returns and the risk free rate or treasury bond returns). Because investors expose themselves to price volatility. Also known as RISK. Put a little differently, volatility aka RISK is good! Because without volatility in the LONG TERM, we would no longer collect the equity risk premium. Now you may ask yourself what is the equity risk premium right now? Well Jeremy Siegel has estimated average stock returns to be 10% in his famous book “Stocks for the Long Run” and if you consider Treasury yields are now in the 4% range then the equity risk premium is 6%. Siegel also argues that over the LONG TERM stocks tend to overcome inflation. He says they have trouble when the Fed tightens (like we are seeing now) but after that, they return to that long-term trend.

We are at a new starting gate here on the verge of Q3 earnings season but keep in mind it’s just one quarter and the race is won over the LONG TERM.

Thanks for reading and have a great weekend!

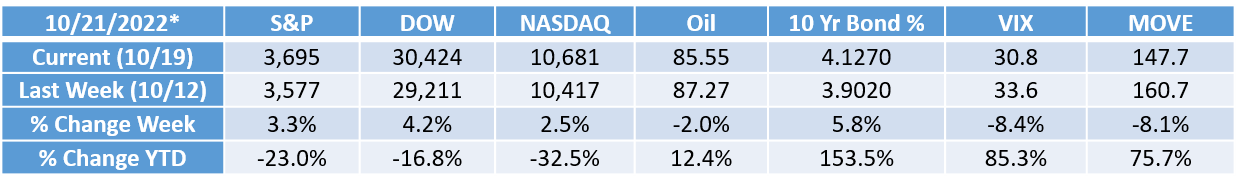

*All data sourced from Yahoo Finance as of the close on the date indicated.

Disclosures

- The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

- There is no assurance that any products or strategies discussed are suitable for all investors or will yield positive outcomes. Any economic forecasts set forth in this note may not develop as predicted.

- All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy.

- Securities offered through LPL Financial, member FINRA/SIPC. Investment advice offered through Great Valley Advisor Group, a registered investment advisor and separate entity from LPL Financial.

Tracking#: 1-05341000